Similar Posts

Plea For Tax Justice In Africa

“Taxation is the price which civilized communities pay for the opportunity of remaining civilized”. …

Independent Continental Youth Advisory Council on AfCFTA And YTJN Collaborate For Youth Involvement in AfCFTA

YTJN & ICOYACA are collaborating to combine their resources and expertise to jointly carry out activities like policy engagements, caravans bazaars, campaigns, etc. aimed at creating awareness of the African Continental Free Trade Area (AfCFTA) amongst the youth.

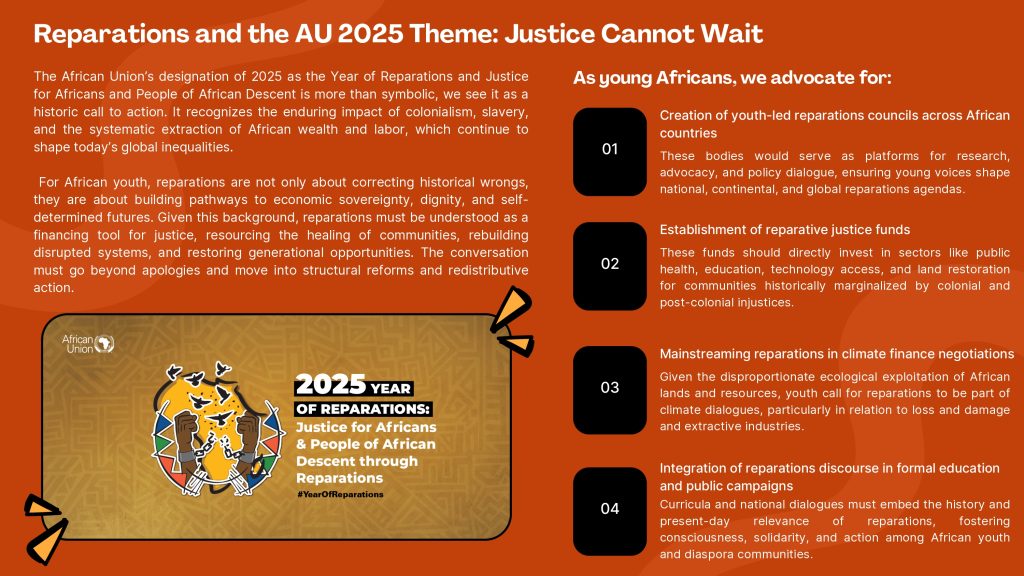

International Youth Day 2025 solidarity statement

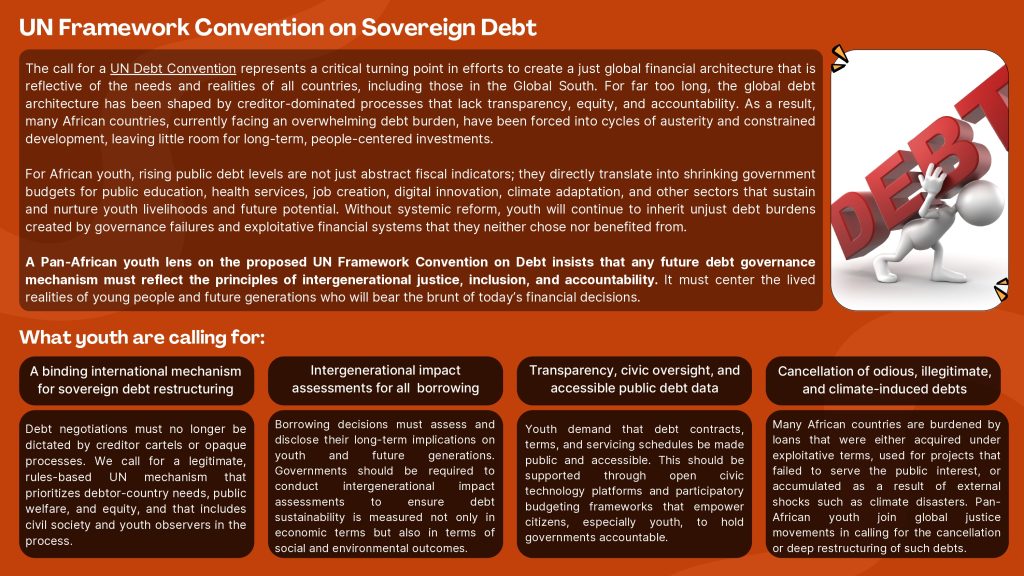

As the Harare Declaration states, the African youth bulge as an engine for the continent’s structural transformation agenda is at risk of being a missed opportunity due to being saddled with accumulated debt, while potentially being locked out of accessing finance that is desperately needed to invest in them, and making them carry the burden of a mortgaged future. Instead of investing in our potential, governments are forced to divert billions to creditors, too often to lenders who prioritise profit over people. This is not only an economic imbalance; it is a generational betrayal. We thus demand debt and tax justice that put people and the planet first.

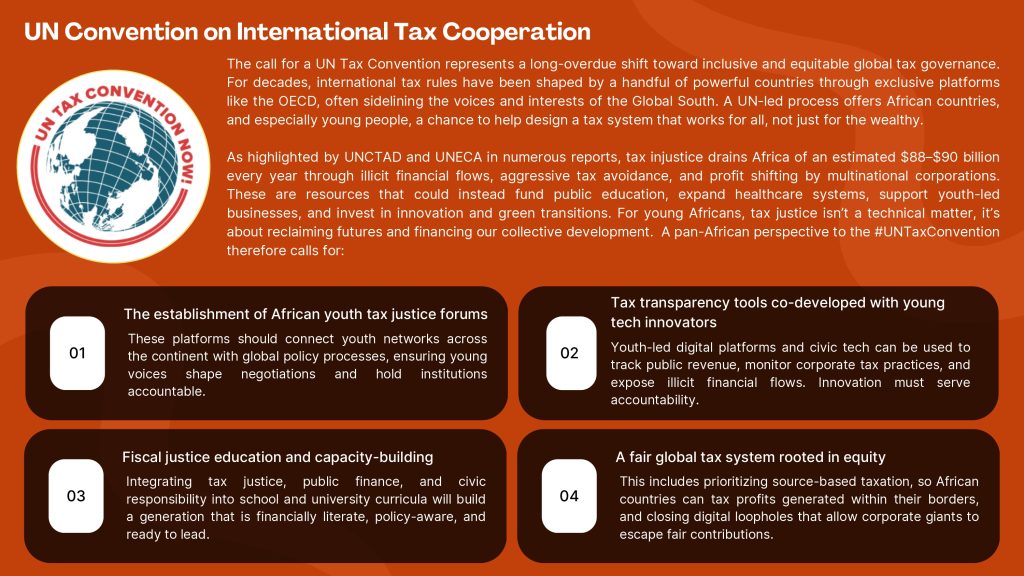

YTJN Nairobi Tax Talks RoundUp: Third Session of the Intergovernmental Negotiating Committee to Develop a UN Framework Convention on International Tax Cooperation – Day 5

Delegates at the 3rd Session of the Intergovernmental Negotiating Committee (INC3) continued working toward the development of a UN Framework Convention on International Tax Cooperation. Friday’s discussions focused on Article 11 on capacity-building and technical assistance, the digitalization of tax administration, sustainability and funding, roles of the Secretariat and COP, and updates from Workstream II on cross-border services.

Dear Uncle

Write I will write againYou said I should not hold back if it’s of gainThe lamentation, the insights…

COP 30 in Belem: What It Meant for Youth and the Future of Climate Finance

This year’s COP, framed as the “implementation COP,” aimed to move beyond promises and focus on how to make climate commitments real. Yet, deep disagreements on finance, trade, fossil fuel pathways, and other areas delayed progress until the final hours. More than 80 countries pushed for a roadmap to phase out fossil fuels, while many advocates and developing nations called for stronger commitments on climate finance, but the final text fell short of expectations.