-

-

YTJN Nairobi Tax Talks Day 7 RoundUp: Third Session of the Intergovernmental Negotiating Committee to Develop a UN Framework Convention on International Tax Cooperation

The conversation then drifted on questions on how to handle disputes in the absence of tax treaties. For developing countries, the answer was simple … “No treaty, no dispute-resolution mechanism.” For them, the Protocol should not create new legal bases.

But across the room, private sector voices insisted that disputes do not wait for treaties; businesses struggle with uncertainty, and governments lose revenue. They pressed for innovations, with some calling for strengthening MAP, others calling for coordinated unilateral Advance Pricing Agreements (APAs), and others for the view that temporary unilateral relief would prevent double taxation. -

YTJN Nairobi Tax Talks RoundUp: Third Session of the Intergovernmental Negotiating Committee to Develop a UN Framework Convention on International Tax Cooperation Day 6

Delegates agreed on the importance of preventing disputes before they occur. Yet tools like advance pricing agreements, joint audits, simultaneous examinations, and cooperative compliance programs remain unevenly accessible. Key views included support for a legal basis enabling cross-border preventive cooperation, strong calls for capacity-building, information-sharing, and improved access to timely data, and emphasis on strengthening information systems and exchange-of-information frameworks. Interests were also seen in optional cross-border prevention mechanisms backed by future best practices and CoP-led support.

-

YTJN Nairobi Tax Talks RoundUp: Third Session of the Intergovernmental Negotiating Committee to Develop a UN Framework Convention on International Tax Cooperation – Day 4

The third intergovernmental session on the UN Tax Convention, hosted in Nairobi, Kenya, has three main objectives: to review the draft text of the Framework Convention negotiations to reach a common understanding on the articles and protocols and develop a more coherent text in the coming months; to provide updates on progress made during the intersessional period on Protocol 1, concerning the taxation of income from cross-border services, with a view to presenting potential options and approaches for the committee’s consideration during the 4th session in February 2026; and to turn to Protocol 2, where the workstream has begun developing preliminary approaches outlined in the concept note.

-

Centering Youth In Global Tax Governance – Your Ultimate Guide to Understanding the UN Tax Convention

In an era marked by deepening inequalities and shifting global financial systems, the question of who decides how resources are raised, shared, and governed has never been more urgent. Taxation, which has been long perceived as a technical issue reserved for experts and state negotiators, is now at the heart of global justice debates. As nations move toward a new United Nations Framework Convention on International Tax Cooperation, the need to ensure inclusivity, fairness, intergenerational equity and legitimacy within this process is critical.

At this critical juncture, the Youth Tax Justice Network (YTJN) stands at the forefront of redefining participation and representation in fiscal processes and fiscourse by championing the voices, priorities, and aspirations of young people across the Global South and beyond. We are backed by the belief and recognition that youth are not merely future taxpayers, but they are present stakeholders, who continue to find ways of organizing, researching, and advocating for a tax system that delivers equity, transparency, and sustainability.

-

Reimagining The Mbeki Report For A New Generation

n 2015, the Mbeki Panel on Illicit Financial Flows (IFFs) unveiled a truth that shook the continent: Africa was losing over $50 billion every year through illicit financial flows, all these are resources that could have transformed education, health, and infrastructure. Reports by the United Nations Economic Commission for Africa (UNECA), UNCTAD and TJNA in recent years have underscored that these amounts are even higher in 2025. The report did more than expose a crisis; it offered a roadmap for reclaiming Africa’s wealth and strengthening domestic resource mobilization.

A decade later, that call for action still resonates, but it now meets a generation ready to act. The Youth for Tax Justice Network (YTJN) represents this renewed energy. It demonstrates the work young people are doing to advance the Mbeki Report’s vision through advocacy, policy dialogue, and youth-led campaigns that push for greater transparency, fair taxation, and accountability across Africa and beyond.

-

International Youth Day 2025 solidarity statement

As the Harare Declaration states, the African youth bulge as an engine for the continent’s structural transformation agenda is at risk of being a missed opportunity due to being saddled with accumulated debt, while potentially being locked out of accessing finance that is desperately needed to invest in them, and making them carry the burden of a mortgaged future. Instead of investing in our potential, governments are forced to divert billions to creditors, too often to lenders who prioritise profit over people. This is not only an economic imbalance; it is a generational betrayal. We thus demand debt and tax justice that put people and the planet first.

-

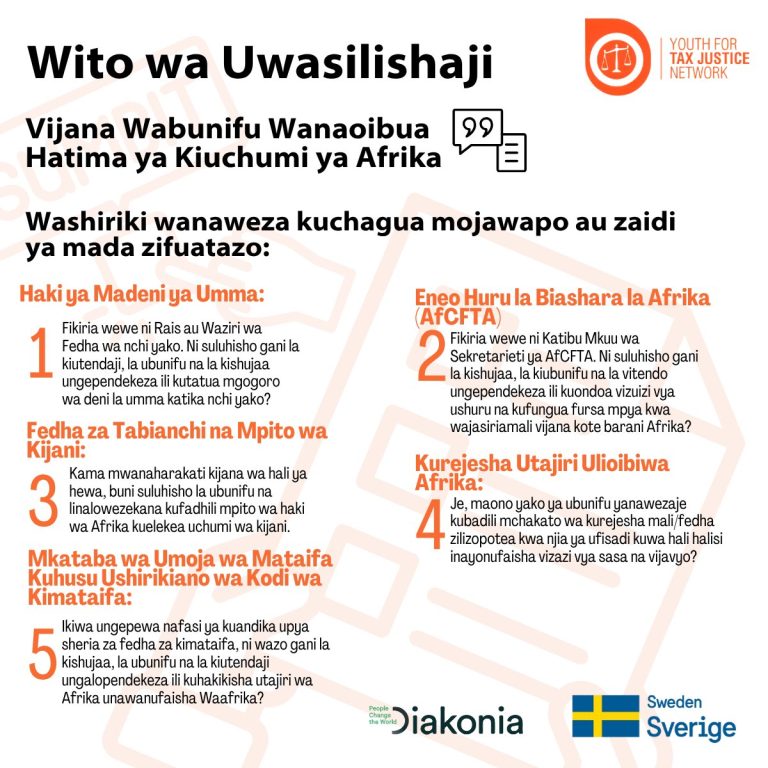

Mashindano ya ubunifu wa vijana wa kiafrika 2025

Kutambua hili, Youth for Tax Justice Network (YTJN) inapendekeza Shindano la Sanaa kwa Vijana Barani Afrika. Lengo ni kutumia ubunifu wa vijana wa Kiafrika kukuza fikra mpya na kuelewa wa ngazi ya jamii kuhusu masuala muhimu ya utawala wa kiuchumi, yakiwemo deni la umma, AfCFTA, fedha za hali ya hewa, urejeshaji wa mali, na Mkataba wa Umoja wa Mataifa kuhusu Ushirikiano wa Kodi wa Kimataifa.

-

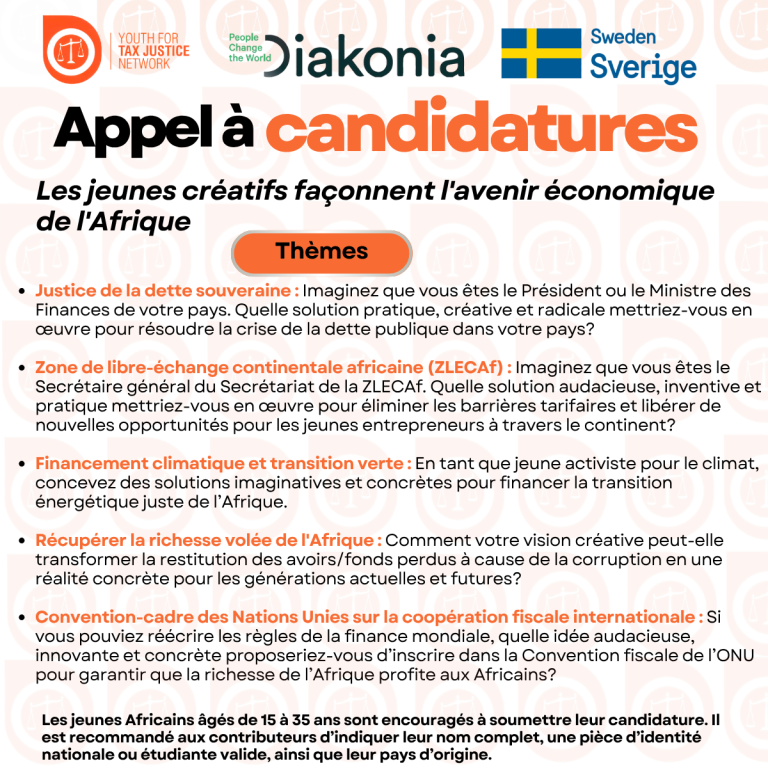

Concours panafricain des jeunes artistes créatifs 2025

C’est dans cette optique que le Youth for Tax Justice Network (YTJN) propose le Concours Panafricain de Jeunes en Arts Créatifs, une initiative qui vise à mobiliser la créativité de la jeunesse africaine afin de stimuler des idées novatrices et une prise de conscience populaire sur des enjeux clés de la gouvernance économique tels que la dette souveraine, la ZLECAf, le financement climatique, la récupération d’actifs et la Convention-cadre des Nations Unies sur la coopération fiscale internationale.

-

Pan African Creative Arts Youth Competition 2025

Youth for Tax Justice Network (YTJN) proposes the Pan African Creative Arts Youth Competition. This initiative seeks to harness the creativity of African youth to foster innovative ideas and grassroots awareness around critical economic governance topics, including sovereign debt, the AfCFTA, climate finance, asset recovery, and the UN Framework Convention on International Tax Cooperation.