“Taxation is the price which civilized communities pay for the opportunity of remaining civilized”. – Albert B. Hart

The relevance of this quote may come across as incomprehensible to Africa, especially the developing countries in the continent. The quote above is roofed and complemented by pure privilege; it is something someone in the line of privilege will allude to. Multinational Enterprises (MNEs) aggressively tax developing countries. The Organization for Economic Cooperation and Development (OECD) has held the sole role of decision making for decades and this has exposed developing countries around the world to global tax abuse. The OECD refuses inclusivity or rule-setting for the lower income countries; they are adamant to refuse a platform of voice to these countries. The ‘price of civilization’ cannot be paid by certain communities and be avoided by others. There is no civilization in tax avoidance & tax evasion and profit shifting.

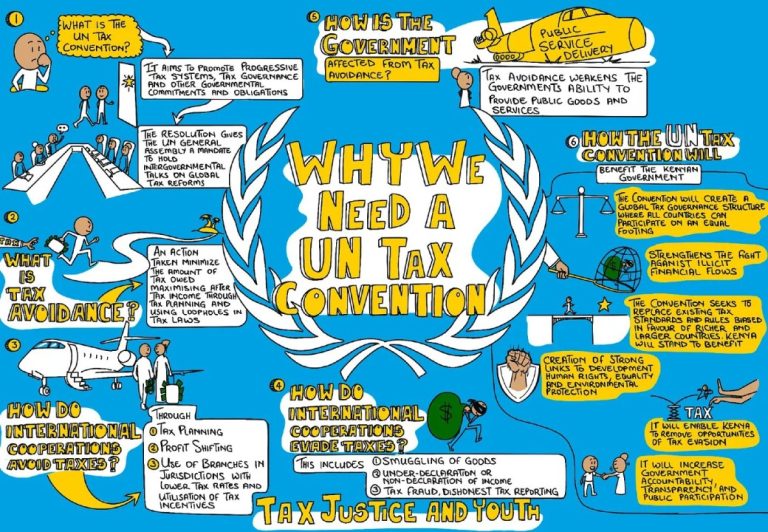

There is an enormous plea for tax justice in Africa, through various organizations such as the Africa Group, Youth for Tax Justice Network, SAPSN, Norwegian Church Aid and many affiliated organizations. In 2019, the African Group at the United Nations called for a UN Convention on Tax and stressed that the group believed such a convention could help to tackle illicit financial flows. This document contains proposals for what a UN Convention on Tax might look like. Imagine an Africa with the UN Tax Convention effective; a platform with an inclusive tax body where lower income countries are given the platform to make decisions on taxation as it is an issue that affects all, mostly developing countries, a global fair fight against illicit financial flows, stronger links to development, human rights and environmental protection, a replaced, adjusted and monitored transfer pricing system, transparency and government accountability and public participation.

Imagine a Namibia with the UN Tax Convention in place… I sit here a proud Namibian, being hit by the beautiful hot sun that falls on every Namibian soul; the rich and the poor, the able and unable. With the bravery bestowed upon me by my forefathers whose blood waters my freedom. Using the talent I have to implore impactful change. As I look around me, every glance shows me why this plea is vital; from the beautiful African twists on my head to the gorgeous not so cheap acrylic set on my nails and my worn-out wobbled-neck laptop as I type this. This is what people would call “rich people problems” but the concept I am trying to convey is that some people cannot afford things outside of their needs and most people cannot even afford their basic needs.

My learners on the other hand have far worse problems than I do, which saddens me to the core. Most do not have breakfast and the other half does not bath when they come to school because of either lack of water or soap or both. Others do not have sanitary pads for that time of the month; the pads provided at schools are only for ‘accidents’, and learners do not get individual packs.Most walk miles to school and back with torn and worn-out shoes and sometimes cannot even afford books to write in or bags to carry to school. All these and other contemporary social issues will be remedied if not entirely erased by the UN Tax Convention and it’s intend for Africa as a whole, pivoting the lower income countries. Namibia will benefit greatly from the UN Tax Convention as it will foster collaboration between governments on taxation matters which will allow countries to participate in the decision making process related to taxation, inclusivity and participation on the part of global south countries and it will ensure high standards of transparency while incorporating the interests, concerns and needs of developing countries.

This is a cry for intervention, a longing for tax justice if you will. All this is impossible and unattainable without the UN Tax Convention. We need a UN Tax Convention to curb all these social economic challenges and pave the way towards a better Namibia. “Harmful tax competition is a text- book example of an international cooperation problem, where individual rationality is at odds with collective rationality”. This now is a quote that sensitizes the importance of tax equality between higher and lower income countries and an urgent requirement for a tax convention that enables and supports inclusion. Namibia and the Youth will benefit greatly from a UN Tax Convention. There will not be a drain of resources desperately needed by countries in the global south to improve the socio-economic well-being of the youth. This Convention will address the negative impacts of the debt and climate crises. I long for the day where Namibia will benefit and reap great rewards from the UN Tax Convention.

I long for the day when the crusty feet of my learners will be comforted by shoes that didn’t cost an arm and a leg. That when I switch on my television I will see them making taxation decisions with higher income countries on platforms created by me, and know that I fought for a better, brighter future where harmful tax competition is done away with. That is the Namibia I imagine.