Similar Posts

Pan African Creative Arts Youth Competition 2025

Youth for Tax Justice Network (YTJN) proposes the Pan African Creative Arts Youth Competition. This initiative seeks to harness the creativity of African youth to foster innovative ideas and grassroots awareness around critical economic governance topics, including sovereign debt, the AfCFTA, climate finance, asset recovery, and the UN Framework Convention on International Tax Cooperation.

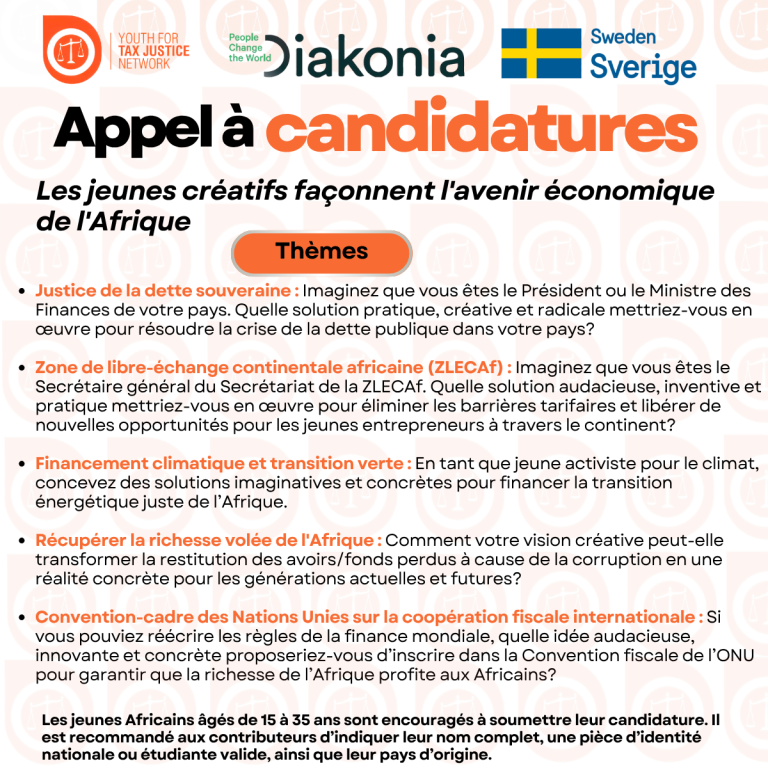

Concours panafricain des jeunes artistes créatifs 2025

C’est dans cette optique que le Youth for Tax Justice Network (YTJN) propose le Concours Panafricain de Jeunes en Arts Créatifs, une initiative qui vise à mobiliser la créativité de la jeunesse africaine afin de stimuler des idées novatrices et une prise de conscience populaire sur des enjeux clés de la gouvernance économique tels que la dette souveraine, la ZLECAf, le financement climatique, la récupération d’actifs et la Convention-cadre des Nations Unies sur la coopération fiscale internationale.

The Role of Youth in Promoting Human Rights and Social Justice in the SADC Region

Apart from engaging in activism and lobbying, young people in the SADC area also use community-based projects to advance social justice and human rights. Numerous youth in the neighborhood participate in community-based initiatives that support social justice and human rights, especially in the fields of economic empowerment, health, and education.

YTJN Nairobi Tax Talks RoundUp: Third Session of the Intergovernmental Negotiating Committee to Develop a UN Framework Convention on International Tax Cooperation – Day 5

Delegates at the 3rd Session of the Intergovernmental Negotiating Committee (INC3) continued working toward the development of a UN Framework Convention on International Tax Cooperation. Friday’s discussions focused on Article 11 on capacity-building and technical assistance, the digitalization of tax administration, sustainability and funding, roles of the Secretariat and COP, and updates from Workstream II on cross-border services.

COP 30 in Belem: What It Meant for Youth and the Future of Climate Finance

This year’s COP, framed as the “implementation COP,” aimed to move beyond promises and focus on how to make climate commitments real. Yet, deep disagreements on finance, trade, fossil fuel pathways, and other areas delayed progress until the final hours. More than 80 countries pushed for a roadmap to phase out fossil fuels, while many advocates and developing nations called for stronger commitments on climate finance, but the final text fell short of expectations.

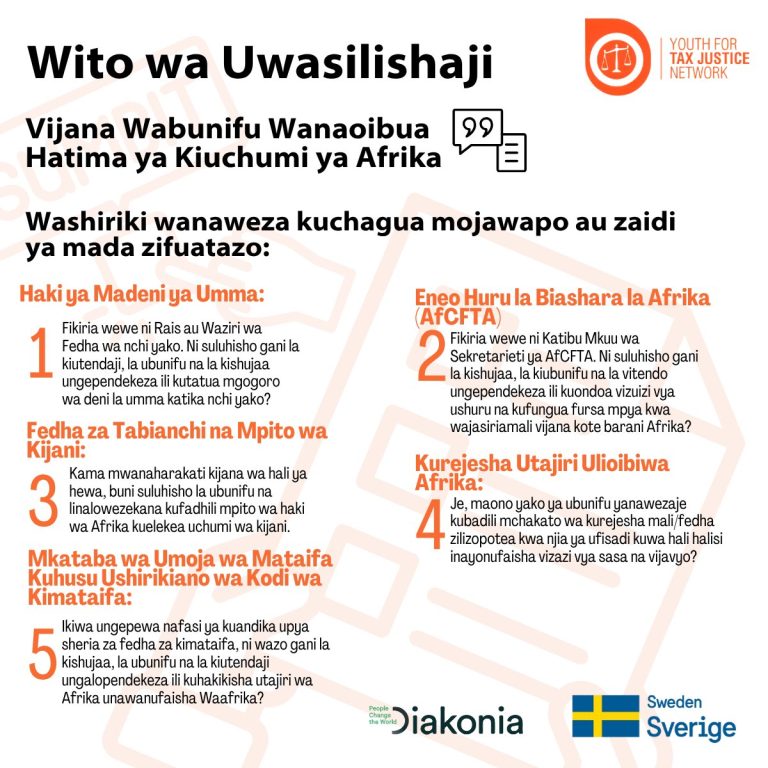

Mashindano ya ubunifu wa vijana wa kiafrika 2025

Kutambua hili, Youth for Tax Justice Network (YTJN) inapendekeza Shindano la Sanaa kwa Vijana Barani Afrika. Lengo ni kutumia ubunifu wa vijana wa Kiafrika kukuza fikra mpya na kuelewa wa ngazi ya jamii kuhusu masuala muhimu ya utawala wa kiuchumi, yakiwemo deni la umma, AfCFTA, fedha za hali ya hewa, urejeshaji wa mali, na Mkataba wa Umoja wa Mataifa kuhusu Ushirikiano wa Kodi wa Kimataifa.