Ce document propose dix principes clés pour aider l’Afrique à affronter le poids de la dette souveraine avec sagesse et souveraineté. Transparence, redevabilité, exigence d’investissements productifs, implication de la jeunesse et construction d’une indépendance financière – autant de piliers pour transformer la dette en levier de développement, et non en outil de dépendance.

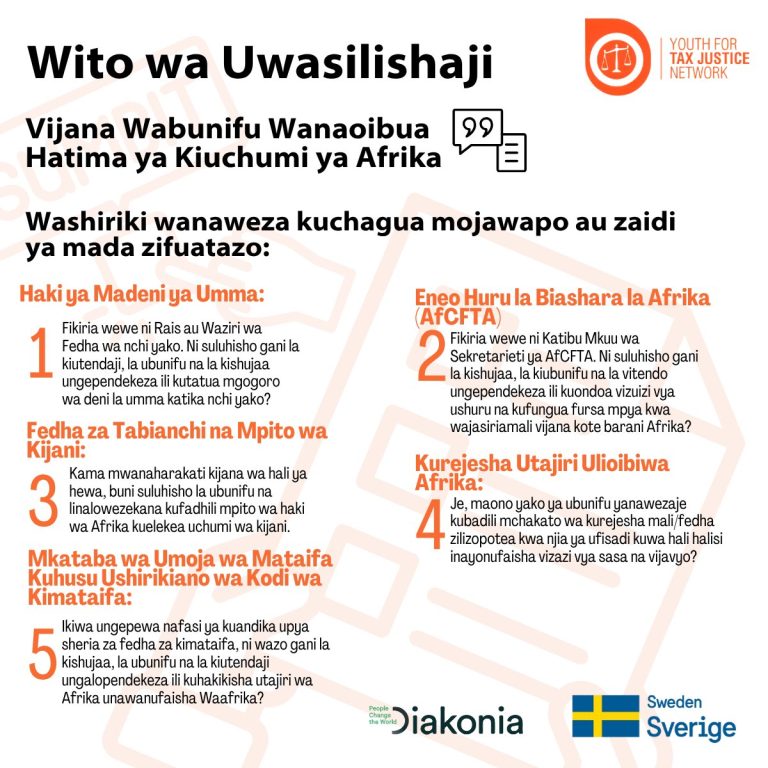

Kutambua hili, Youth for Tax Justice Network (YTJN) inapendekeza Shindano la Sanaa kwa Vijana Barani Afrika. Lengo ni kutumia ubunifu wa vijana wa Kiafrika kukuza fikra mpya na kuelewa wa ngazi ya jamii kuhusu masuala muhimu ya utawala wa kiuchumi, yakiwemo deni la umma, AfCFTA, fedha za hali ya hewa, urejeshaji wa mali, na Mkataba wa Umoja wa Mataifa kuhusu Ushirikiano wa Kodi wa Kimataifa.

The Youth for Tax Justice Network (YTJN), in collaboration with partners including, Africa-Europe Foundation and the Southern Africa Youth Forum (SAYoF) is spearheading a side event at the Fourth International Conference on Financing for Development (FfD4).

Youth for Tax Justice Network (YTJN) proposes the Pan African Creative Arts Youth Competition. This initiative seeks to harness the creativity of African youth to foster innovative ideas and grassroots awareness around critical economic governance topics, including sovereign debt, the AfCFTA, climate finance, asset recovery, and the UN Framework Convention on International Tax Cooperation.

Uganda’s participation in the UNFCCC process continues to affirm our unwavering commitment to global climate action, sustainable development, and resilience building. As one of the Least Developed Countries (LDCs), Uganda remains steadfast in advocating for fairness, equity, and access to finance, technology, and capacity building under the principle of Common but Differentiated Responsibilities and Respective Capabilities (CBDR–RC).

The conversation then drifted on questions on how to handle disputes in the absence of tax treaties. For developing countries, the answer was simple … “No treaty, no dispute-resolution mechanism.” For them, the Protocol should not create new legal bases.

But across the room, private sector voices insisted that disputes do not wait for treaties; businesses struggle with uncertainty, and governments lose revenue. They pressed for innovations, with some calling for strengthening MAP, others calling for coordinated unilateral Advance Pricing Agreements (APAs), and others for the view that temporary unilateral relief would prevent double taxation.