Similar Posts

Climate and tax justice: why one couldn’t go without the other

This November, young people from across the world come together to explore an urgent connection that few are talking about: how the UN Climate Conference (COP 30) in Belém and the UN negotiations for a Framework Convention on International Tax Cooperation in Nairobi are part of the same story.

YTJN Nairobi Tax Talks Day 7 RoundUp: Third Session of the Intergovernmental Negotiating Committee to Develop a UN Framework Convention on International Tax Cooperation

The conversation then drifted on questions on how to handle disputes in the absence of tax treaties. For developing countries, the answer was simple … “No treaty, no dispute-resolution mechanism.” For them, the Protocol should not create new legal bases.

But across the room, private sector voices insisted that disputes do not wait for treaties; businesses struggle with uncertainty, and governments lose revenue. They pressed for innovations, with some calling for strengthening MAP, others calling for coordinated unilateral Advance Pricing Agreements (APAs), and others for the view that temporary unilateral relief would prevent double taxation.

Plea For Tax Justice In Africa

“Taxation is the price which civilized communities pay for the opportunity of remaining civilized”. …

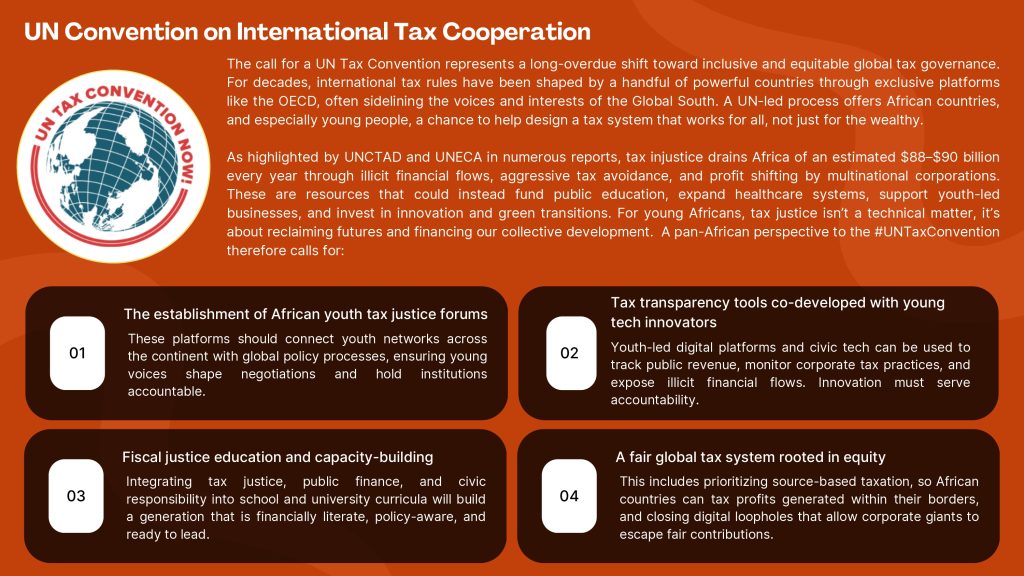

Centering Youth In Global Tax Governance – Your Ultimate Guide to Understanding the UN Tax Convention

In an era marked by deepening inequalities and shifting global financial systems, the question of who decides how resources are raised, shared, and governed has never been more urgent. Taxation, which has been long perceived as a technical issue reserved for experts and state negotiators, is now at the heart of global justice debates. As nations move toward a new United Nations Framework Convention on International Tax Cooperation, the need to ensure inclusivity, fairness, intergenerational equity and legitimacy within this process is critical.

At this critical juncture, the Youth Tax Justice Network (YTJN) stands at the forefront of redefining participation and representation in fiscal processes and fiscourse by championing the voices, priorities, and aspirations of young people across the Global South and beyond. We are backed by the belief and recognition that youth are not merely future taxpayers, but they are present stakeholders, who continue to find ways of organizing, researching, and advocating for a tax system that delivers equity, transparency, and sustainability.

Botswana Economic Crisis Sparks Youth-led Fiscal Overhaul Ahead of 4th Financing For Development Conference.

As Batswana grapple with a BWP 22 billion budget deficit (9% of GDP in 2024), rising public debt of 27.4% of GDP, squeezing funds for youth-centric programs and youth unemployment at 43.86%, underscoring the urgency of prioritizing job creation and social services for the nation’s youth-dominated population (70% under 35), the FfD4 presents an opportunity for Batswana to redefine global rules on sovereign debt, a critical issue for Botswana as diamond revenue volatility strains public finances.

East African Community Youth Policy 2013

Download Full Policy