Similar Posts

YTJN Nairobi Tax Talks RoundUp: Third Session of the Intergovernmental Negotiating Committee to Develop a UN Framework Convention on International Tax Cooperation Day 6

Delegates agreed on the importance of preventing disputes before they occur. Yet tools like advance pricing agreements, joint audits, simultaneous examinations, and cooperative compliance programs remain unevenly accessible. Key views included support for a legal basis enabling cross-border preventive cooperation, strong calls for capacity-building, information-sharing, and improved access to timely data, and emphasis on strengthening information systems and exchange-of-information frameworks. Interests were also seen in optional cross-border prevention mechanisms backed by future best practices and CoP-led support.

United Nations Climate Change Conference – Uganda At COP30

Uganda’s participation in the UNFCCC process continues to affirm our unwavering commitment to global climate action, sustainable development, and resilience building. As one of the Least Developed Countries (LDCs), Uganda remains steadfast in advocating for fairness, equity, and access to finance, technology, and capacity building under the principle of Common but Differentiated Responsibilities and Respective Capabilities (CBDR–RC).

World Environment Day 2025: Beat Plastic Pollution

As we approach World Environment Day on June 5, 2025, under the theme of “Beat Plastic Pollution,” we believe it is crucial to address the intertwined issues of plastic pollution and environmental degradation in our community.

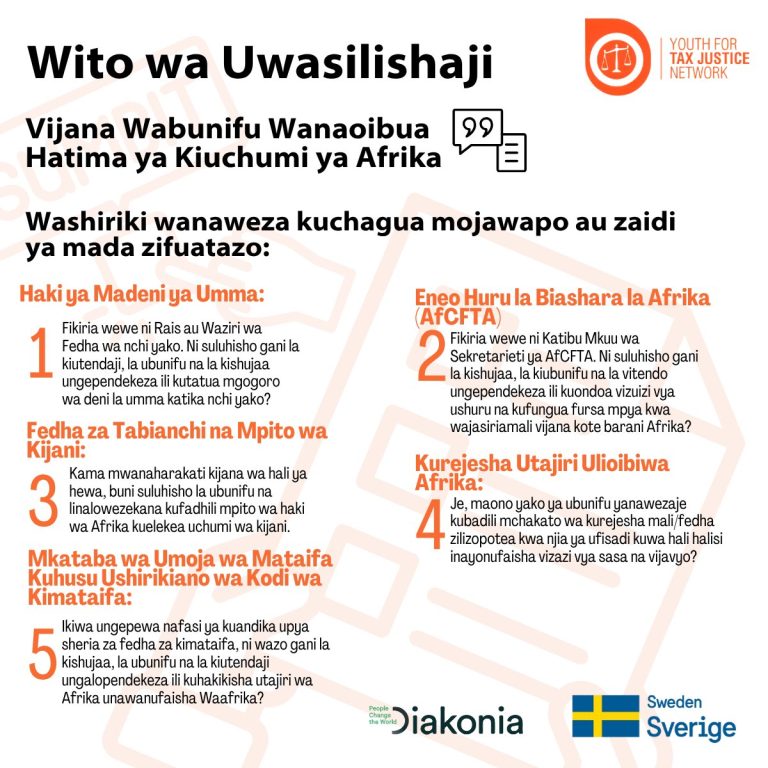

Mashindano ya ubunifu wa vijana wa kiafrika 2025

Kutambua hili, Youth for Tax Justice Network (YTJN) inapendekeza Shindano la Sanaa kwa Vijana Barani Afrika. Lengo ni kutumia ubunifu wa vijana wa Kiafrika kukuza fikra mpya na kuelewa wa ngazi ya jamii kuhusu masuala muhimu ya utawala wa kiuchumi, yakiwemo deni la umma, AfCFTA, fedha za hali ya hewa, urejeshaji wa mali, na Mkataba wa Umoja wa Mataifa kuhusu Ushirikiano wa Kodi wa Kimataifa.

Austrian Development Cooperation and YTJN collaborate in Youth Climate Action Project

Towards the end of August, Austrian Development Cooperation and YTJN signed a grant agreement to implement a project titled Youth…

International Youth Day 2025 solidarity statement

As the Harare Declaration states, the African youth bulge as an engine for the continent’s structural transformation agenda is at risk of being a missed opportunity due to being saddled with accumulated debt, while potentially being locked out of accessing finance that is desperately needed to invest in them, and making them carry the burden of a mortgaged future. Instead of investing in our potential, governments are forced to divert billions to creditors, too often to lenders who prioritise profit over people. This is not only an economic imbalance; it is a generational betrayal. We thus demand debt and tax justice that put people and the planet first.