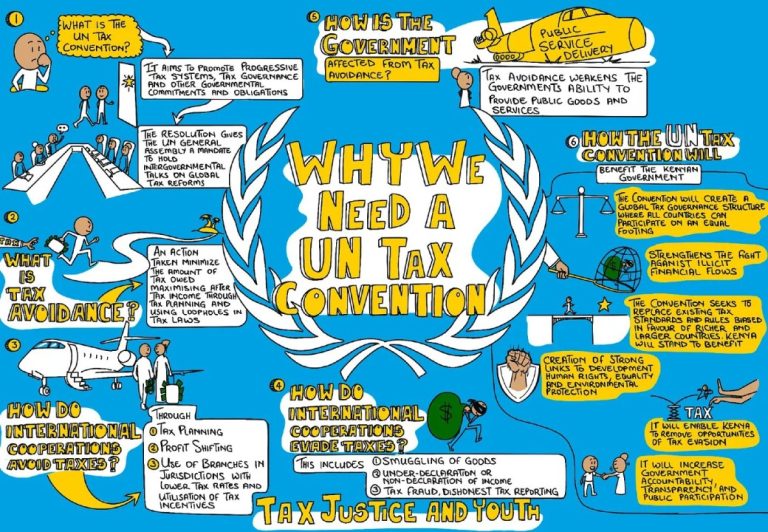

In an era marked by deepening inequalities and shifting global financial systems, the question of who decides how resources are raised, shared, and governed has never been more urgent. Taxation, which has been long perceived as a technical issue reserved for experts and state negotiators, is now at the heart of global justice debates. As nations move toward a new United Nations Framework Convention on International Tax Cooperation, the need to ensure inclusivity, fairness, intergenerational equity and legitimacy within this process is critical.

At this critical juncture, the Youth Tax Justice Network (YTJN) stands at the forefront of redefining participation and representation in fiscal processes and fiscourse by championing the voices, priorities, and aspirations of young people across the Global South and beyond. We are backed by the belief and recognition that youth are not merely future taxpayers, but they are present stakeholders, who continue to find ways of organizing, researching, and advocating for a tax system that delivers equity, transparency, and sustainability.

Youth should care. The main reason is because we’re paying, but not heard. Africa is the youngest continent in the world, with over 60% of its population under the age of 25. Yet despite being the majority, young people are among the most heavily taxed, especially through consumption taxes such as VAT on airtime, mobile money, transport, and everyday goods.

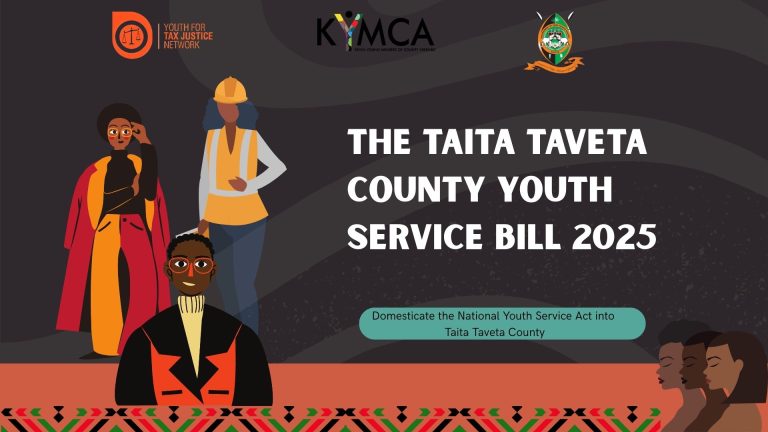

YTJN intends to once again collaborate with KYMCA to hold public hearings for the Bill with the citizens and the Assembly and then have the MCAs debate the Bill in the Assembly. This Bill once passed into law is expected to address youth unemployment, insufficient domestic resource mobilization, food insecurity, double taxation of youth operating in small and medium enterprises, teenage pregnancies, skillset mismatch amongst the youth, limited youth participation in formulation of policies and laws at County level among others.

Attention class! Welcome for this free tutorial that you didn’t even sign up for, But Listen; Grab a…

The tools he fought to place in our hands—the laws, the freedoms, the hope—are now ours to wield. Let us honor the whole of his journey—the triumphs and the scars—by building a future so just and free that it becomes his greatest testament.