Similar Posts

COP 30 in Belem: What It Meant for Youth and the Future of Climate Finance

This year’s COP, framed as the “implementation COP,” aimed to move beyond promises and focus on how to make climate commitments real. Yet, deep disagreements on finance, trade, fossil fuel pathways, and other areas delayed progress until the final hours. More than 80 countries pushed for a roadmap to phase out fossil fuels, while many advocates and developing nations called for stronger commitments on climate finance, but the final text fell short of expectations.

East African Community Youth Policy 2013

Download Full Policy

Contre la dette stérile

Ce document propose dix principes clés pour aider l’Afrique à affronter le poids de la dette souveraine avec sagesse et souveraineté. Transparence, redevabilité, exigence d’investissements productifs, implication de la jeunesse et construction d’une indépendance financière – autant de piliers pour transformer la dette en levier de développement, et non en outil de dépendance.

YTJN Nairobi Tax Talks RoundUp: Third Session of the Intergovernmental Negotiating Committee to Develop a UN Framework Convention on International Tax Cooperation Day 6

Delegates agreed on the importance of preventing disputes before they occur. Yet tools like advance pricing agreements, joint audits, simultaneous examinations, and cooperative compliance programs remain unevenly accessible. Key views included support for a legal basis enabling cross-border preventive cooperation, strong calls for capacity-building, information-sharing, and improved access to timely data, and emphasis on strengthening information systems and exchange-of-information frameworks. Interests were also seen in optional cross-border prevention mechanisms backed by future best practices and CoP-led support.

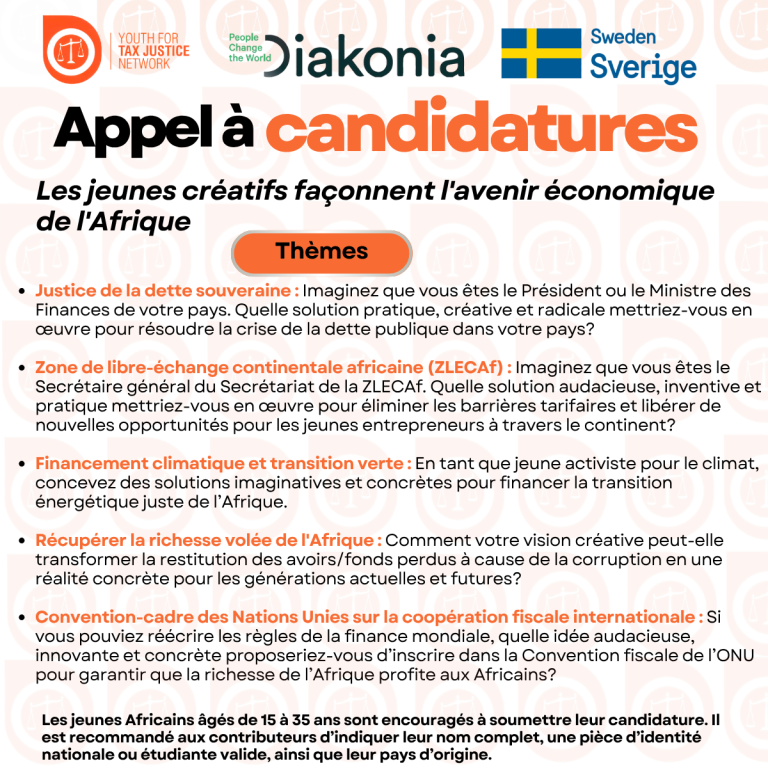

Concours panafricain des jeunes artistes créatifs 2025

C’est dans cette optique que le Youth for Tax Justice Network (YTJN) propose le Concours Panafricain de Jeunes en Arts Créatifs, une initiative qui vise à mobiliser la créativité de la jeunesse africaine afin de stimuler des idées novatrices et une prise de conscience populaire sur des enjeux clés de la gouvernance économique tels que la dette souveraine, la ZLECAf, le financement climatique, la récupération d’actifs et la Convention-cadre des Nations Unies sur la coopération fiscale internationale.