Similar Posts

The 2026-2031 Uganda National Youth Manifesto

By addressing the challenges of youth unemployment through targeted investments in skills development, health, and education and by leveraging digital technologies, Uganda can harness the potential of its young population to drive sustainable development and economic growth. Government Ministries, Departments and Agencies will collaborate extensively with Development Partners, Civil Society Organizations and young people’s movements to realize a demographic dividend and the aspirations of this National Youth Manifesto.

The Southern Consultations In Windhoek Namibia 2023

The 2016 Africa Human Development Report highlights that gender inequality is costing sub-Saharan Africa on average US$95 billion annually. Gender equality is therefore instrumental to achieving sustainable economic and social development and should be mainstreamed into Africa’s trade agenda to achieve sustainable and inclusive economic growth. Domestic resource mobilization has become a concern for economies in the global south because of the changing international financial architecture.

YTJN Nairobi Tax Talks RoundUp: Third Session of the Intergovernmental Negotiating Committee to Develop a UN Framework Convention on International Tax Cooperation – Day 4

The third intergovernmental session on the UN Tax Convention, hosted in Nairobi, Kenya, has three main objectives: to review the draft text of the Framework Convention negotiations to reach a common understanding on the articles and protocols and develop a more coherent text in the coming months; to provide updates on progress made during the intersessional period on Protocol 1, concerning the taxation of income from cross-border services, with a view to presenting potential options and approaches for the committee’s consideration during the 4th session in February 2026; and to turn to Protocol 2, where the workstream has begun developing preliminary approaches outlined in the concept note.

Pan African Youth Perspectives on FFD

Africa, home to the youngest and fastest growing population globally, has faced shrinking fiscal space, capital flight, and uneven access to international financial markets. For African youth, who not only represent over 70% of the continent’s population but also the continent’s potential drivers of innovation and growth, these challenges translate into restricted opportunities, heightened vulnerabilities, and a fragile future.

Contre la dette stérile

Ce document propose dix principes clés pour aider l’Afrique à affronter le poids de la dette souveraine avec sagesse et souveraineté. Transparence, redevabilité, exigence d’investissements productifs, implication de la jeunesse et construction d’une indépendance financière – autant de piliers pour transformer la dette en levier de développement, et non en outil de dépendance.

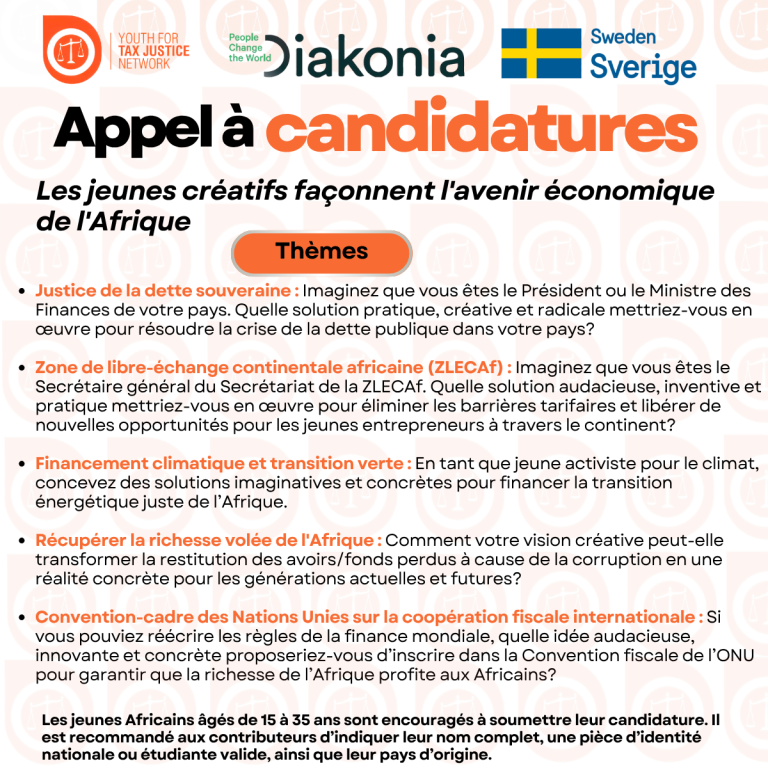

Concours panafricain des jeunes artistes créatifs 2025

C’est dans cette optique que le Youth for Tax Justice Network (YTJN) propose le Concours Panafricain de Jeunes en Arts Créatifs, une initiative qui vise à mobiliser la créativité de la jeunesse africaine afin de stimuler des idées novatrices et une prise de conscience populaire sur des enjeux clés de la gouvernance économique tels que la dette souveraine, la ZLECAf, le financement climatique, la récupération d’actifs et la Convention-cadre des Nations Unies sur la coopération fiscale internationale.