Similar Posts

Botswana Economic Crisis Sparks Youth-led Fiscal Overhaul Ahead of 4th Financing For Development Conference.

As Batswana grapple with a BWP 22 billion budget deficit (9% of GDP in 2024), rising public debt of 27.4% of GDP, squeezing funds for youth-centric programs and youth unemployment at 43.86%, underscoring the urgency of prioritizing job creation and social services for the nation’s youth-dominated population (70% under 35), the FfD4 presents an opportunity for Batswana to redefine global rules on sovereign debt, a critical issue for Botswana as diamond revenue volatility strains public finances.

COP 30 in Belem: What It Meant for Youth and the Future of Climate Finance

This year’s COP, framed as the “implementation COP,” aimed to move beyond promises and focus on how to make climate commitments real. Yet, deep disagreements on finance, trade, fossil fuel pathways, and other areas delayed progress until the final hours. More than 80 countries pushed for a roadmap to phase out fossil fuels, while many advocates and developing nations called for stronger commitments on climate finance, but the final text fell short of expectations.

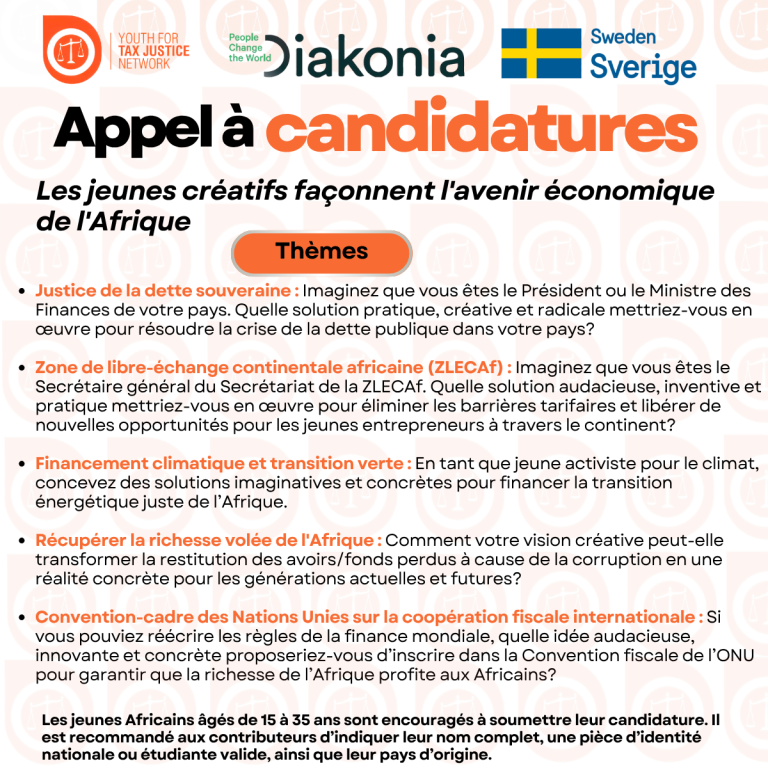

Concours panafricain des jeunes artistes créatifs 2025

C’est dans cette optique que le Youth for Tax Justice Network (YTJN) propose le Concours Panafricain de Jeunes en Arts Créatifs, une initiative qui vise à mobiliser la créativité de la jeunesse africaine afin de stimuler des idées novatrices et une prise de conscience populaire sur des enjeux clés de la gouvernance économique tels que la dette souveraine, la ZLECAf, le financement climatique, la récupération d’actifs et la Convention-cadre des Nations Unies sur la coopération fiscale internationale.

YTJN Nairobi Tax Talks Day 7 RoundUp: Third Session of the Intergovernmental Negotiating Committee to Develop a UN Framework Convention on International Tax Cooperation

The conversation then drifted on questions on how to handle disputes in the absence of tax treaties. For developing countries, the answer was simple … “No treaty, no dispute-resolution mechanism.” For them, the Protocol should not create new legal bases.

But across the room, private sector voices insisted that disputes do not wait for treaties; businesses struggle with uncertainty, and governments lose revenue. They pressed for innovations, with some calling for strengthening MAP, others calling for coordinated unilateral Advance Pricing Agreements (APAs), and others for the view that temporary unilateral relief would prevent double taxation.