Similar Posts

Youth Letter to Delegates Negotiating the UN Tax Convention Negotiations

We write to you as the Youth for Tax Justice Network (YTJN), a global, youth-led coalition advocating for inclusive and equitable

tax systems that serve the needs of both present and future generations across Africa and Europe. As the Intergovernmental

Negotiating Committee deliberates on the United Nations Framework Convention on International Tax Cooperation in New York,

we urge you to recognize this moment for what it is: a generational turning point.

Third Session of UN Tax Convention Negotiations Kicks Off in Nairobi as Governments Begin Text-Based Discussions

For young people across Africa and the world, these negotiations represent more than just policy debates. They offer an unprecedented opportunity to shape an economic future focused on intergenerational equity, where every resource counts, and where fiscal justice becomes a tool for equality, innovation, and opportunity.

The Southern Consultations In Windhoek Namibia 2023

The 2016 Africa Human Development Report highlights that gender inequality is costing sub-Saharan Africa on average US$95 billion annually. Gender equality is therefore instrumental to achieving sustainable economic and social development and should be mainstreamed into Africa’s trade agenda to achieve sustainable and inclusive economic growth. Domestic resource mobilization has become a concern for economies in the global south because of the changing international financial architecture.

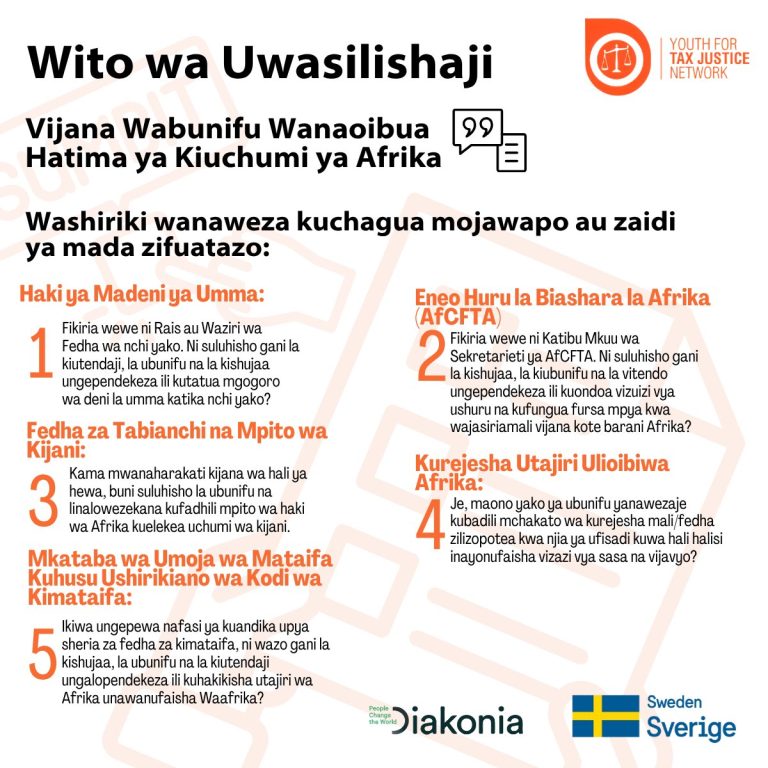

Mashindano ya ubunifu wa vijana wa kiafrika 2025

Kutambua hili, Youth for Tax Justice Network (YTJN) inapendekeza Shindano la Sanaa kwa Vijana Barani Afrika. Lengo ni kutumia ubunifu wa vijana wa Kiafrika kukuza fikra mpya na kuelewa wa ngazi ya jamii kuhusu masuala muhimu ya utawala wa kiuchumi, yakiwemo deni la umma, AfCFTA, fedha za hali ya hewa, urejeshaji wa mali, na Mkataba wa Umoja wa Mataifa kuhusu Ushirikiano wa Kodi wa Kimataifa.

Intergovernmental Negotiations on the UN Tax Convention Resume in New York with Renewed Opportunity to Center Youth Voices in Global Tax Governance

Specifically, the Youth Tax Justice Network (YTJN) will be present at the Fourth INC Session, advocating for youth-inclusive tax governance, intergenerational accountability, and transparent fiscal systems that respond to the social and economic realities facing young people globally. YTJN aims to contribute youth-centered perspectives to ongoing debates on taxing rights, transparency, and international cooperation against tax abuse.

United Nations Climate Change Conference – Uganda At COP30

Uganda’s participation in the UNFCCC process continues to affirm our unwavering commitment to global climate action, sustainable development, and resilience building. As one of the Least Developed Countries (LDCs), Uganda remains steadfast in advocating for fairness, equity, and access to finance, technology, and capacity building under the principle of Common but Differentiated Responsibilities and Respective Capabilities (CBDR–RC).