By addressing the challenges of youth unemployment through targeted investments in skills development, health, and education and by leveraging digital technologies, Uganda can harness the potential of its young population to drive sustainable development and economic growth. Government Ministries, Departments and Agencies will collaborate extensively with Development Partners, Civil Society Organizations and young people’s movements to realize a demographic dividend and the aspirations of this National Youth Manifesto.

For youth participants, we see a distinct perspective, emphasizing that the current tax system often leaves Global South countries underfunded, limiting investments in youth employment, education, and digital access. We continue to highlight that failing to adapt taxation to modern digital economies risks perpetuating inequalities: large digital corporations operating in developing countries can avoid paying fair shares, while young entrepreneurs face regulatory burdens that stifle innovation. Civil society representatives reinforced these points, calling for tax rules that account for historical disparities between wealthy and developing nations. Discussions reflected a tension between protecting traditional national revenue sources and reforming systems to ensure equitable contributions from globalized business models.

Delegates at the 3rd Session of the Intergovernmental Negotiating Committee (INC3) continued working toward the development of a UN Framework Convention on International Tax Cooperation. Friday’s discussions focused on Article 11 on capacity-building and technical assistance, the digitalization of tax administration, sustainability and funding, roles of the Secretariat and COP, and updates from Workstream II on cross-border services.

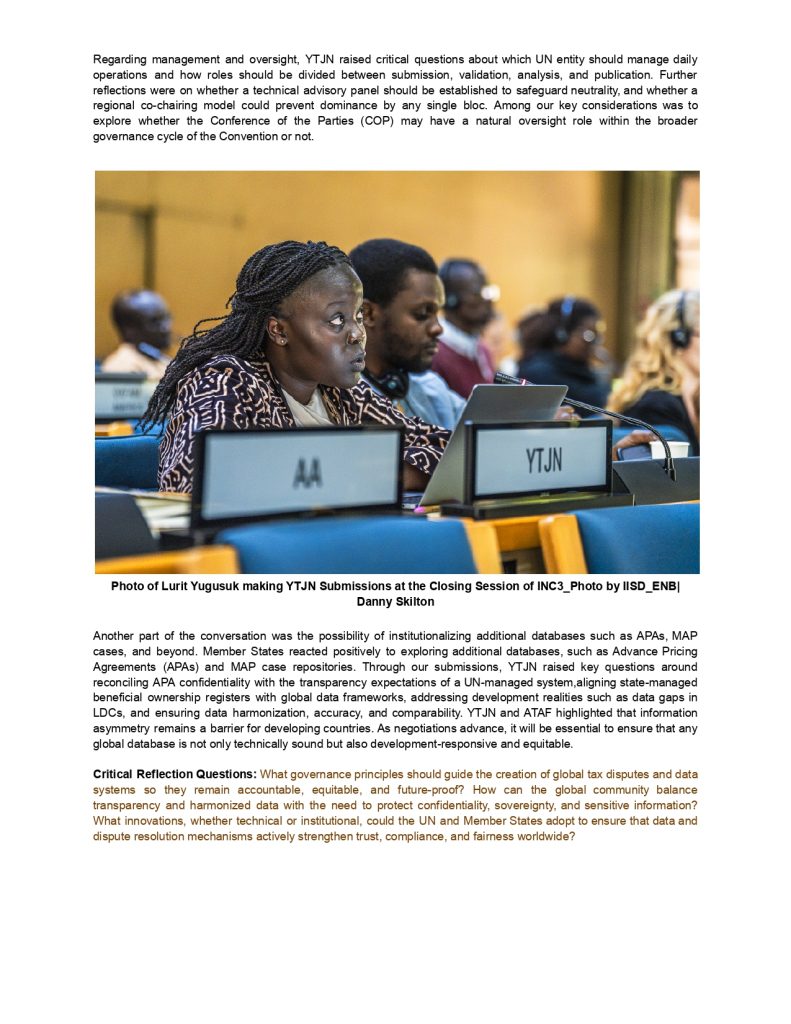

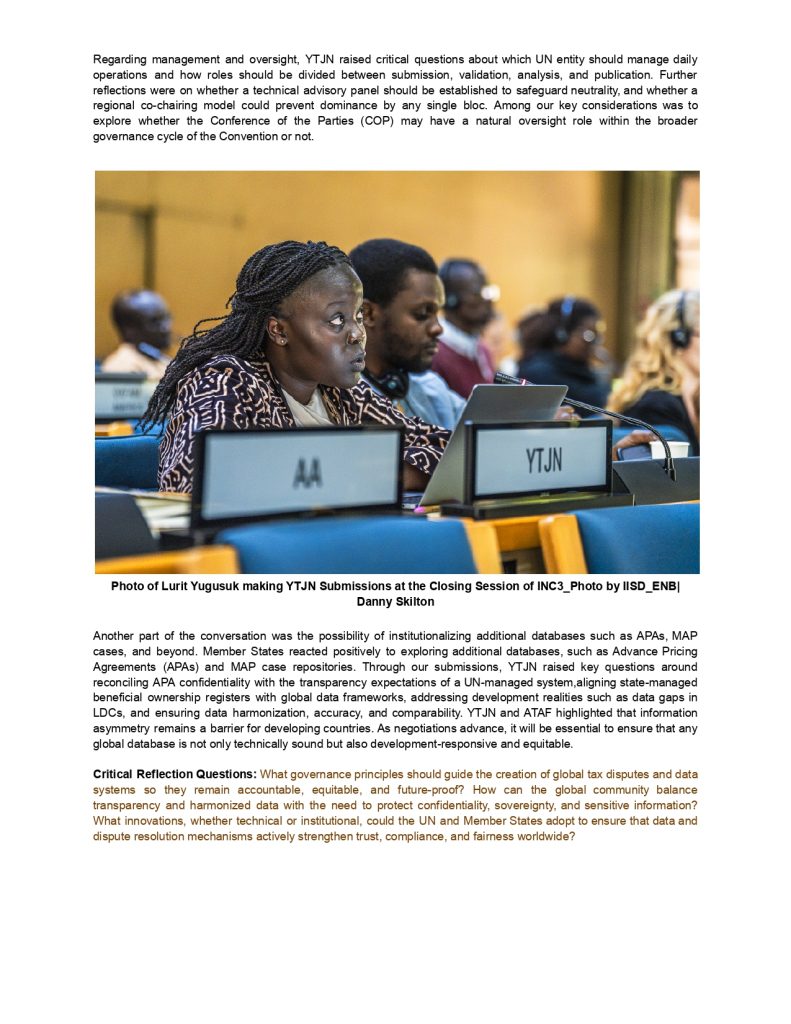

Lurit Yugusuk, speaking for the Youth for Tax Justice Network, reminded the room that harmful tax practices don’t just affect balance sheets, they affect people.“Harmful tax practices erode national tax bases, weakening the capacity to finance education, healthcare, and infrastructure that children and youth depend on.” She called for expanding Article 8 beyond multinational enterprises to include high-net-worth individuals, private investment vehicles, and professional enablers. She also pushed for mandatory public disclosure of tax incentives and public country-by-country reporting, emphasizing that “secrecy has been the lifeblood of harmful tax practices.”

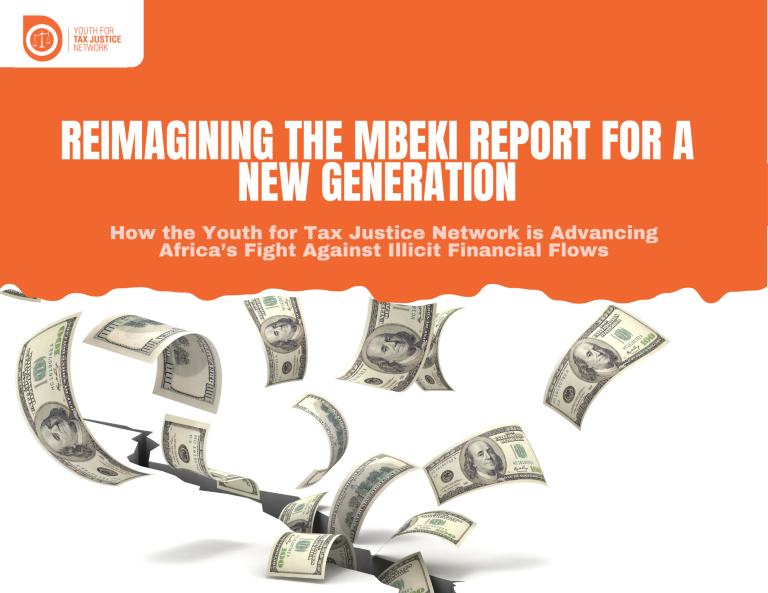

n 2015, the Mbeki Panel on Illicit Financial Flows (IFFs) unveiled a truth that shook the continent: Africa was losing over $50 billion every year through illicit financial flows, all these are resources that could have transformed education, health, and infrastructure. Reports by the United Nations Economic Commission for Africa (UNECA), UNCTAD and TJNA in recent years have underscored that these amounts are even higher in 2025. The report did more than expose a crisis; it offered a roadmap for reclaiming Africa’s wealth and strengthening domestic resource mobilization.

A decade later, that call for action still resonates, but it now meets a generation ready to act. The Youth for Tax Justice Network (YTJN) represents this renewed energy. It demonstrates the work young people are doing to advance the Mbeki Report’s vision through advocacy, policy dialogue, and youth-led campaigns that push for greater transparency, fair taxation, and accountability across Africa and beyond.

It’s a call to action for youth to rise, engage, demand, and drive transformative change and co-creators of a new financing paradigm that truly serves the people and the planet. This piece is also a call to action for governments, multi-lateral institutions and civil society organizations to rise to the challenge of meaningful youth inclusion.