As the Harare Declaration states, the African youth bulge as an engine for the continent’s structural transformation agenda is at risk of being a missed opportunity due to being saddled with accumulated debt, while potentially being locked out of accessing finance that is desperately needed to invest in them, and making them carry the burden of a mortgaged future. Instead of investing in our potential, governments are forced to divert billions to creditors, too often to lenders who prioritise profit over people. This is not only an economic imbalance; it is a generational betrayal. We thus demand debt and tax justice that put people and the planet first.

YTJN & ICOYACA are collaborating to combine their resources and expertise to jointly carry out activities like policy engagements, caravans bazaars, campaigns, etc. aimed at creating awareness of the African Continental Free Trade Area (AfCFTA) amongst the youth.

Lurit Yugusuk, speaking for the Youth for Tax Justice Network, reminded the room that harmful tax practices don’t just affect balance sheets, they affect people.“Harmful tax practices erode national tax bases, weakening the capacity to finance education, healthcare, and infrastructure that children and youth depend on.” She called for expanding Article 8 beyond multinational enterprises to include high-net-worth individuals, private investment vehicles, and professional enablers. She also pushed for mandatory public disclosure of tax incentives and public country-by-country reporting, emphasizing that “secrecy has been the lifeblood of harmful tax practices.”

The 2016 Africa Human Development Report highlights that gender inequality is costing sub-Saharan Africa on average US$95 billion annually. Gender equality is therefore instrumental to achieving sustainable economic and social development and should be mainstreamed into Africa’s trade agenda to achieve sustainable and inclusive economic growth. Domestic resource mobilization has become a concern for economies in the global south because of the changing international financial architecture.

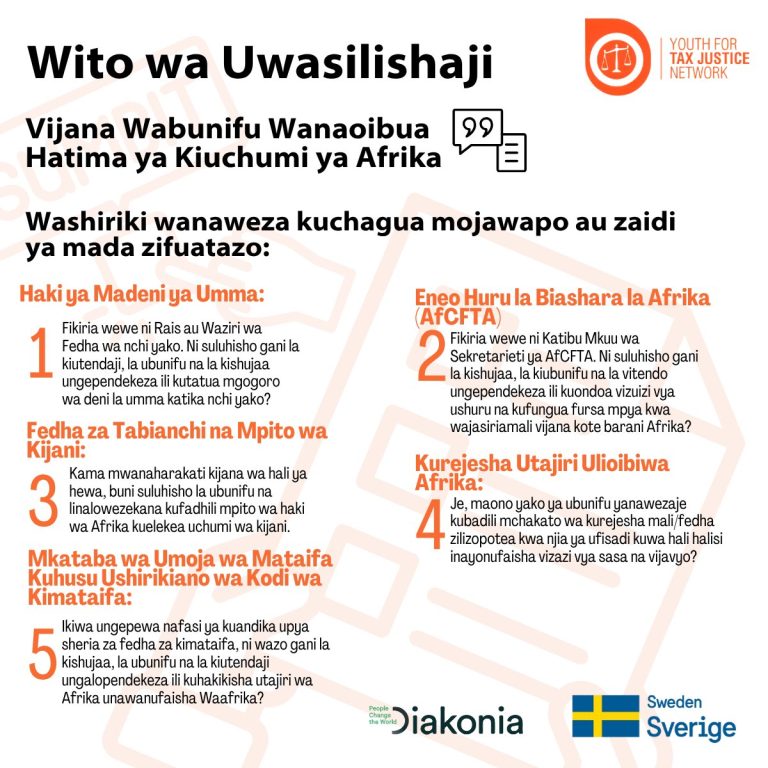

Kutambua hili, Youth for Tax Justice Network (YTJN) inapendekeza Shindano la Sanaa kwa Vijana Barani Afrika. Lengo ni kutumia ubunifu wa vijana wa Kiafrika kukuza fikra mpya na kuelewa wa ngazi ya jamii kuhusu masuala muhimu ya utawala wa kiuchumi, yakiwemo deni la umma, AfCFTA, fedha za hali ya hewa, urejeshaji wa mali, na Mkataba wa Umoja wa Mataifa kuhusu Ushirikiano wa Kodi wa Kimataifa.