We write to you as the Youth for Tax Justice Network (YTJN), a global, youth-led coalition advocating for inclusive and equitable

tax systems that serve the needs of both present and future generations across Africa and Europe. As the Intergovernmental

Negotiating Committee deliberates on the United Nations Framework Convention on International Tax Cooperation in New York,

we urge you to recognize this moment for what it is: a generational turning point.

We recognize that the youth of Southern Africa represent an immense reservoir of energy, creativity, and potential that is critical to the continued progress and prosperity of our communities. As present leaders and change-makers of our region, we have a vital role to play in addressing the complex social, political, economic, and environmental challenges that we face. We have a role to complement our governments, the private sector, and all developmental actors to ensure access to quality and affordable education for the SADC child.

Lurit Yugusuk, speaking for the Youth for Tax Justice Network, reminded the room that harmful tax practices don’t just affect balance sheets, they affect people.“Harmful tax practices erode national tax bases, weakening the capacity to finance education, healthcare, and infrastructure that children and youth depend on.” She called for expanding Article 8 beyond multinational enterprises to include high-net-worth individuals, private investment vehicles, and professional enablers. She also pushed for mandatory public disclosure of tax incentives and public country-by-country reporting, emphasizing that “secrecy has been the lifeblood of harmful tax practices.”

Download Full Report HERE

The youth of Kenya are a most resourceful, innovative, and active segment of our society. It generates ideas and their applications to spur and catalyse social and economic transformation.

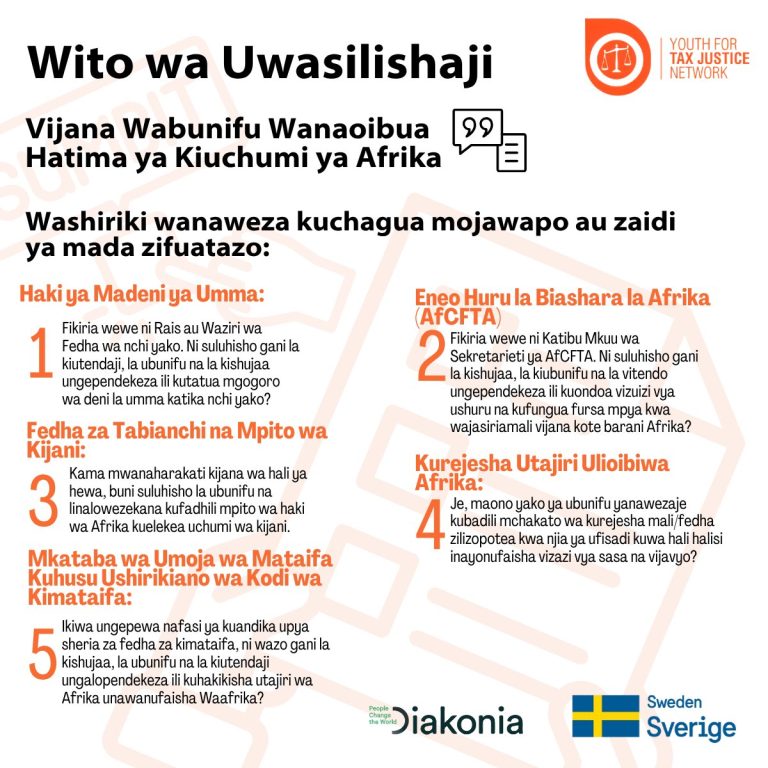

Kutambua hili, Youth for Tax Justice Network (YTJN) inapendekeza Shindano la Sanaa kwa Vijana Barani Afrika. Lengo ni kutumia ubunifu wa vijana wa Kiafrika kukuza fikra mpya na kuelewa wa ngazi ya jamii kuhusu masuala muhimu ya utawala wa kiuchumi, yakiwemo deni la umma, AfCFTA, fedha za hali ya hewa, urejeshaji wa mali, na Mkataba wa Umoja wa Mataifa kuhusu Ushirikiano wa Kodi wa Kimataifa.